M&A 101

to dream is to build. To fight back is to Scale. On purpose.

New to M&A? Welcome. You’re in the right place.

Mergers & Acquisitions don’t have to be shady, sharky, or extractive. Here’s how founders like you are using M&A to scale their values not just their revenue.

This page is for B Corps, social enterprises, and purpose-led founders who want to grow but don’t want to sell out.

We built this to answer the questions you might not even know you should be asking yet, including:

What actually happens during an acquisition?

How do you fund a deal without lots of capital?

Can I use M&A to scale my mission?

Spoiler: You can. And we’re going to show you how.

Before you start, grab the Golden Rule Roadmap — your M&A journey, simplified.

It’s a free, visual guide to navigating a mission-driven acquisition from first conversation to post-close integration.

1.M&A Roadmap

Here’s what the M&A process actually looks like- minus the jargon and Wall Street drama.

2. how to fund & structure a deal

Think you need millions in the bank or a call from Goldman? Think again.

Founders we work with are using structures like these to buy businesses without compromising their values or their balance sheets.

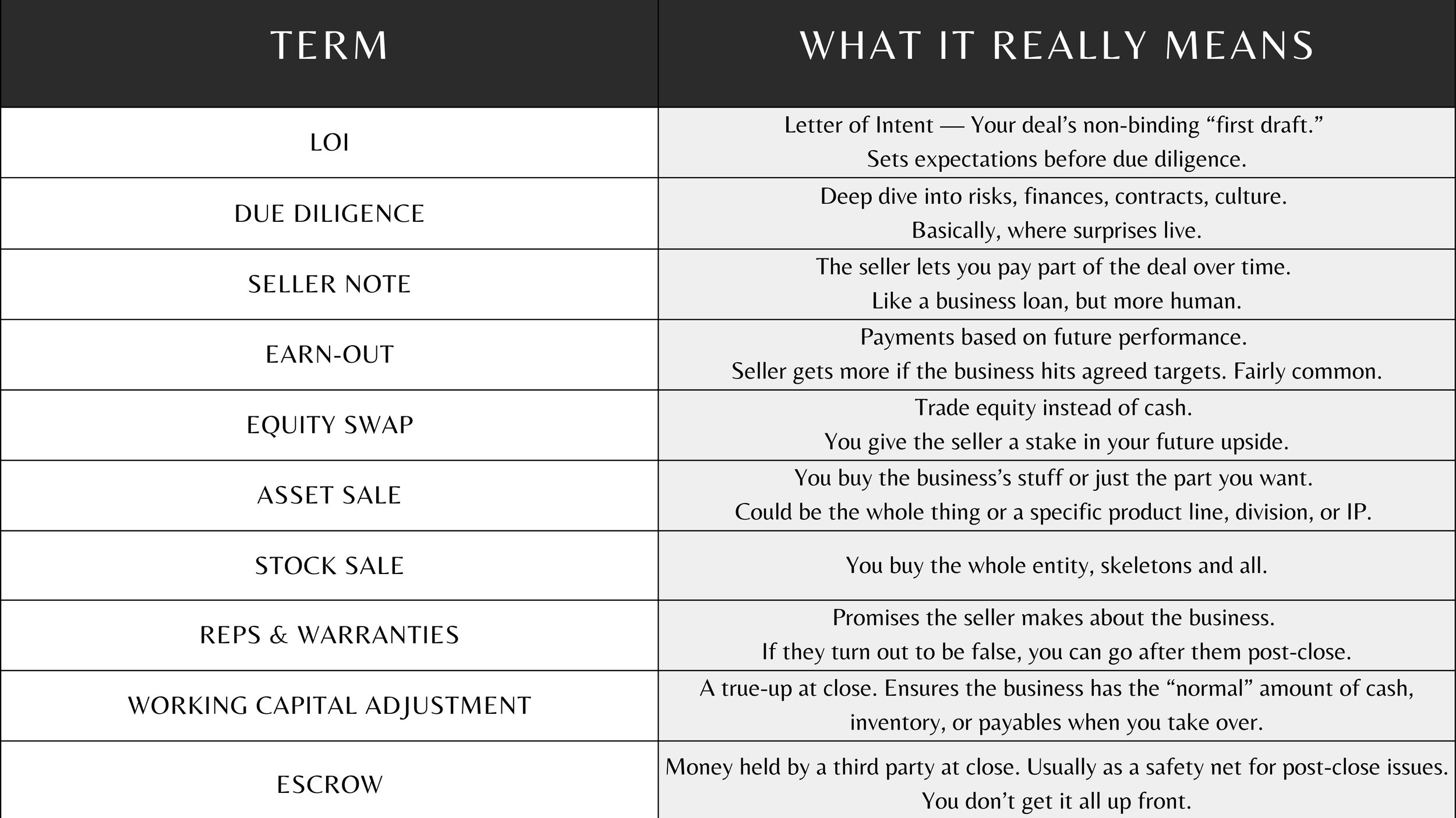

3. Key Terms to know

Clarity builds confidence especially when you’re stepping into something that feels big.

4. Case studies: Scaling Good, IRL

So what does this look like in real-life? How could it work for you?

Civil Engineering Firm

A firm in the built environment space used a roll-up strategy to bring smaller, like-minded businesses into their ecosystem without ever taking outside money or selling to private equity. They remained 100% employee-owned, giving every team member a stake in the growth.

→ Proof that ethical M&A can scale both revenue and ownership, building equity for everyone involved.Impact-Driven Agency Collective

When a $5M agency set its sights on becoming a $100M collective, the founder partnered with us to turn that vision into a structured acquisition strategy. By relying on seller-financing, profit-sharing, and mission-aligned partnerships instead of outside capital or cash, they’re proving that growth can multiply impact without tying up working capital or taking on debt.

→ Proof that thoughtful, off-market sourcing and creative deal structures make M&A accessible and mission-accelerating.Professional Services Firm

A founder came to us thinking M&A was all suits, spreadsheets, and sharks. Five months later, they’d closed a creative seller-financed deal with a complementary firm that shared their values—and added $1M to the topline.

→ Proof that no outside capital or dilution is needed. Just bold action that changed the game for impact.Food & CPG Brand

This values-driven B Corp scaled nationally by acquiring complementary product lines. They stayed employee-owned, protected their supply chain standards, and held tight to their purpose in every term sheet.

→ Proof that you can build a national brand without selling out. Every new aisle, every new region, still reflects their values.

Bottom line?

M&A isn’t just about what you gain. It’s about how you grow.

and who grows with you.

…and it is more accessible than you think.